Ever heard of a sound sample that came out better than the original? Hard to think of any, right? How about I introduce you to Smart Money Doctor? Almost everyone knows what comes to mind when you hear ‘smart money’. But the IFUMSA Financial Seminar, themed Smart Money Doctor, did it better!

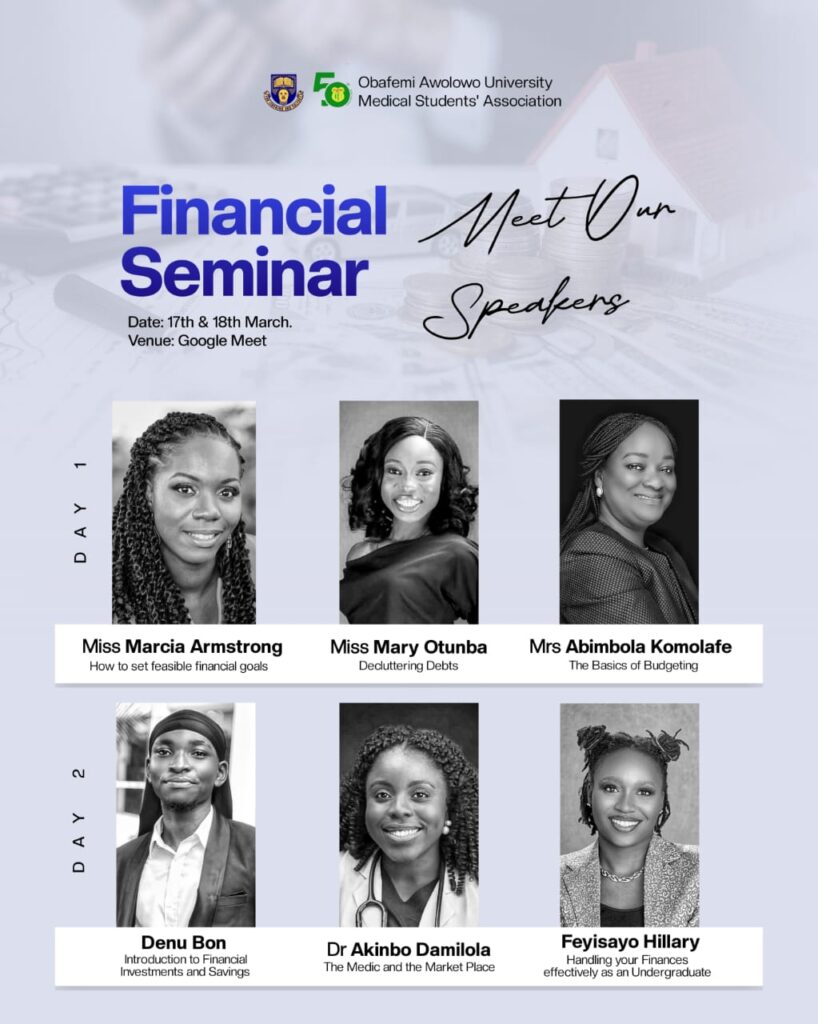

The 2-day Seminar happened on March 17th and 18th, 2023 (Friday and Saturday, respectively), with speakers giving valuable insights on finance and some extras (you don’t come by every day) to be that smart money medic.

Smart Money DAY 1

The session started at 4:00 pm and lasted until 6:30 pm. Eniola Arogundade, who welcomed the participants and introduced the three speakers for the evening, moderated the session. The speakers took turns educating the attendees extensively on various topics. For Friday evening, we had:

A. How to Set Feasible Financial Goals

Ms Marcia Armstrong, a finance operations expert based in Barbados, led this impactful segment. She began by providing a broad overview of goals and why having them is essential. She then discussed the S.M.A.R.T. model for translating big dreams into short-, medium-, or long-term financial goals, which was crucial in creating and achieving goals intentionally and objectively for a higher chance of success.

Once financial goals are established, the next step is to incorporate them into your budget. This makes it easier to determine the income and expenditure required daily to achieve those goals. Ms Marcia emphasized that small efforts like this go a long way; as Dave Ramsey once said, “Financial freedom is 80% behaviour and 20% knowledge.“

B. Basics of Budgeting

The speaker for this segment was Mrs Abimbola Komolafe, a certified financial education instructor and the C.E.O. of Threshold of Trust Nigeria Ltd. She served justice to this topic, beginning her talk by stressing that financial freedom is the basis and goal of the discussion. She explained that a person achieves financial freedom when your passive income exceeds all your needs or wants requirements. Another term, financial fitness, was introduced as being in control of one’s money, which is the building block of wealth creation. This building block comprises four elements, including budgeting, which she further discussed in detail.

She shared an ideology that if Christians say the devil finds work for idle hands, the same goes for idle money, which budgeting eliminates. Mrs Abimbola also mentioned that habits, priorities, and lifestyle are important factors when creating a budget. Finally, she discussed the 50:30:20 budgeting rule for needs, wants, and savings but recommended that students stretch themselves further and use a 50:50 principle for needs and savings, respectively.

Here are some key takeaways from her presentation:

Things to Remember

- Your list should reflect your priorities.

- Adjust your goals as your priorities change by reviewing your budget.

- Budgeting is not a quick job.

- If your expenses don’t go as planned, it’s okay. Life happens but be sure to try again.

If you don’t budget, what happens?

- Overspending: You gradually lose track of your numbers.

- Debt cycle: However, debt is not always bad because it can be a tool for wealth creation.

- Limited spending power: When this happens, one’s savings and investments may take a hit.

- No financial freedom!

C. Decluttering Debts

Ms Mary Otunba, a Financial Analyst at Andersen, presented a concise and well-organized topic on decluttering debts. During the session, she explained the two primary debt repayment methods: the debt snowball and the debt avalanche methods. The debt snowball method involves paying off the smallest loans first, while the debt avalanche method prioritizes loans with the highest interest rates.

Furthermore, Ms Otunba shared practical tips to help individuals eliminate their debts. These tips include documenting all debts in one place to have a holistic view of what is owed, creating a plan and using reminders like sticky notes, cutting down on expenses, avoiding planning debt repayment based on projected income, and working strictly with the available funds. She also emphasized increasing income to match the debt repayment commitment.

The session ended with a vote of thanks from the IFUMSACRACY Treasurer, Ms Claire Akuwaba.

Smart Money DAY 2

Day 2 was as power-packed as Day 1 or even more. The Seminar started at 10:00 am and was moderated by Amarachi Godswill-Nwankwo. She greeted everyone and asked those around for Day 1 to share what they had learned. She introduced the speakers, and Day 2 was officially in full swing.

A.Introduction to Financial Investments and Savings:

Mr Denu Bon, the chairman of Denu’s money circle Ltd was our first speaker of the day. Esther Arowosola read his citation, and he began his powerful lecture. He began by giving us a brief history of how he started investments and savings, also mentioning how some books could radically change one’s mindset. He gave examples of books that helped his financial growth; Think and Grow Rich by Napoleon Hill, The Alchemist by Paulo Coelho and his favourite- The Richest man in Babylon by George Samuel Clason.

Furthermore, he mentioned that most individuals lack the financial skills to pursue their passions. An individual must learn to use maximise the available capital for maximum profit. “Investment is a vehicle for the full usage of money,” he said, defining investment as systems that help you use your money to gain more money.

He gave the budget style Denu’s smart money circle used: 70%-needs, 10%-Emergency, 10%-Tithes and 10%-Investment. He also advised people to get involved in trading activities, buying and selling alongside investments.

His lecture came to an end with a Q and A session. One such question was, “Is borrowing money for an investment okay?” He responded that it is called leverage and can be dicey. Do not use leverage on speculative investments.

B. The Medic and The Marketplace:

Dr Oluwadamilola Akinbo, an Alumnus of IFUMSA and the founder of Onestop Medsupplies, led this insightful segment. Clare Awkuba read her citation. Dr Oluwadamilola, who was on call while handling the session, thanked the organizers and encouraged medical students to keep pushing and be holistic doctors.

She talked about her experience balancing medicine, business and her passions. She mentioned that medical students have a place in business. Furthermore, Dr Oluwdamilola mentioned that although medical practice makes you comfortable, it alone cannot make you wealthy. She added that those rich doctors are those who have discovered their entrepreneurship side.

Dr Oluwadamilola went on to talk about what business entails and the types. She advised that even as a medical doctor, you should understand business fundamentals. Then, she listed easy and straightforward steps to start a business:

- Identify a need/Interest

- Choose your niche

- Market Survey

- Having a working business plan

- Get Capital

- Start!

She concluded this fantastic session by charging us to balance medicine and business. Telling us to make sure we excel in both.

C. Handling Your Finances Actively as Undergraduates.

Mrs Fisayo Awopetu Hilary, also an Alumnus of O.A.U. and founder of the Millennials wealth club, was our final speaker who gave a superb lecture. Seyi Ige, who read her citation, equally welcomed her.

Mrs Fisayo mentioned that it is essential to understand our environment and what works for us.

She charged us to invest in ourselves-self development as an undergraduate. She gave examples of online courses, attending seminars and gaining more knowledge. Mrs Fisayo also mentioned that for you to be able to invest in yourself, you need savings. Funding your self-development requires funds that can be acquired through savings.

Furthermore, She talked about accountability. How creating budgets and tracking your expenses are measures. She recommended writing down your spending. She also advised avoiding Ponzi schemes.

As all good things must have an end, with a final Q and A session for Mrs Fisayo, the Smart Money Doctor seminar ended. The moderator invited Gbeminiyi Ajeleti to give the closing speech. He thanked the speakers for their time and those who attended the Seminar. He also told the audience to look forward to more of The Smart Money Doctor Series.

We hope this helped you get some of the vital lessons you missed out on.

For more of such events Medivoive has covered, please click here. Don’t forget to share this with your friends so they too can stay informed. Until next time.

Leave a Reply